Should Your Business Have a 'Death Plan'?

for real

Happy Monday! The start of a new week brings new opportunities and fresh energy. Let's tackle those goals with purpose and make this week count!

Here’s a positive thought for the day:

"The only way to do great work is to love what you do”

Passion fuels creativity. When you enjoy your work, you're more open to exploring new ideas and taking risks, which can lead to innovation. In challenging times, passion can keep you motivated. It becomes easier to push through difficulties when you genuinely care about what you're doing.

With that in mind, let’s get started…

🎯 Top Headlines of the Day

HDFC Bank increases loan interest rates by 5 basis points

Tomato prices soar to Rs 100 and continue climbing

Passenger vehicle sales saw a 19% decline in September

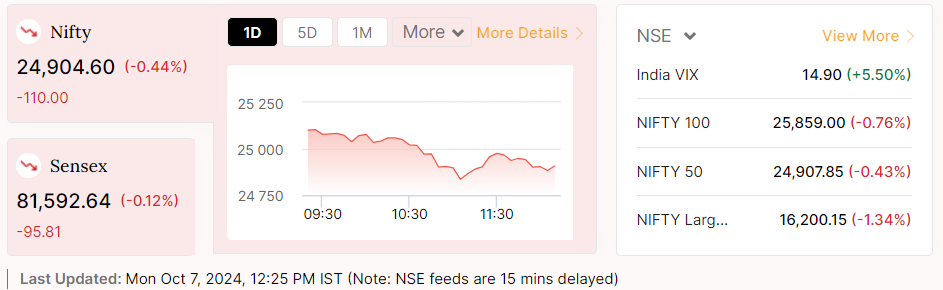

📊 Market Pulse

Today’s top-performing stocks are:

Today’s low-performing stocks are:

Does your business need a “death plan?”

Did you know Kodak planned its exit from film photography decades before digital cameras took over? Their strategy allowed them to pivot into patent licensing. Or look at Polaroid, whose “death” sparked a retro rebirth with a smaller, niche focus.

These businesses embraced change, knowing that their first chapters would inevitably close—and it led to innovation. Death isn’t the end; it’s just another phase of transformation.

What Is a Business “Death Plan?”

A business death plan isn’t just about shutting down operations; it’s about planning for graceful exits, transitions, or transformations. It’s acknowledging that even the most successful businesses face an inevitable end—whether due to market changes, technological disruptions, or even personal reasons.

Think of it like estate planning for businesses. You wouldn’t leave your personal finances in disarray, so why treat your business differently? The goal is to proactively plan for how your business will transition, evolve, or gracefully exit the stage without chaos.

Why Bother? Isn't That Too Negative?

Not really! Think of it as preserving your business’s legacy rather than letting circumstances dictate an unplanned downfall. Here’s why a death plan could be crucial:

📌 Smooth Transitions

Whether you're thinking about selling your business, merging with another company, or passing the torch to someone new, these are huge moves. Without a plan, they can be chaotic and leave everyone involved—your employees, customers, and stakeholders—feeling confused, anxious, or even betrayed.

That’s where a detailed exit strategy comes in. It’s like creating a roadmap for when you’re no longer in the driver’s seat. With a well-thought-out plan, you can make sure that the transition feels smooth, seamless, and secure for everyone.

📌 Protecting Relationships

Imagine this: your business is thriving, relationships are solid, and everything seems smooth. Then, something unexpected happens—market shifts, personal reasons, or even burnout—and you realize it’s time to close the doors. Now, think about how your customers, partners, and employees might react if they’re caught off guard.

This is where a death plan comes in. It’s not just about tying up loose ends—it’s about transparency and respect. Instead of vanishing into thin air, a death plan ensures that everyone involved knows what’s happening and why. You’re giving them time to adjust, offering solutions, and maintaining the relationships you’ve built over the years.

📌 Avoiding the Trap of Holding On

Let’s be honest—letting go of your business can feel like saying goodbye to a part of yourself. After all, you’ve poured years of hard work, passion, and sleepless nights into building it. But here’s where many founders hit a roadblock: they get so attached to the business that they can’t imagine life without it, even when the signs of decline are staring them right in the face.

When a business stops growing, it doesn’t always happen with a dramatic crash. Often, it’s more like a slow fade—stagnation sets in, innovation stalls and the spark that once fueled your vision dims.

This is where a death plan becomes your reality check. It forces you to confront the possibility that the business might need a drastic change—whether that’s a major pivot to adapt to market shifts, a partnership with a competitor, or, yes, even closing the doors for good.

What Could a Business Death Plan Look Like?

📌 End-of-Life Financial Strategies

When you’ve decided to wind things down, what happens to all that you've built? From your office space and equipment to your inventory and cash reserves—these assets don’t just disappear. You’ll need to think about who gets what and how.

Will you sell off your physical assets and pay off any outstanding debts? Perhaps you’d like to liquidate slowly, ensuring that your employees and suppliers are paid first before any remaining funds go to investors or back into your pocket.

Or, what if you decide to donate some assets to causes you care about? A business with a soul might find comfort in making its exit meaningful, contributing to charity, or reinvesting in the community.

These are just a few questions to ponder when it comes to end-of-life financial strategies. It's not just about closing the door but also making sure you’re maximizing the value of everything you’ve built—long after you’ve moved on to the next chapter.

📌 Employee Transitions

When a business comes to an end, one of the toughest questions is: What happens to the people who helped you build it? Your employees have been part of your journey, and it’s crucial to think about how they’ll move forward when the chapter closes.

A solid death plan should include strategies to make this transition as smooth as possible. This could be through outplacement services—essentially offering career coaching, job placement assistance, or even skills training to help them land their next role. It’s like giving your team a soft landing after the storm.

Another approach is offering severance packages. While it might not soften the blow entirely, a well-structured severance can give your employees some breathing room, allowing them to navigate this change without immediate financial stress. It’s a way of saying, “We value your contribution, even as this chapter ends.”

📌 Customer Continuity

When a business closes its doors, the customers who’ve been loyal to you might feel lost, confused, or even frustrated. That’s why it’s so important to ask yourself: How will I help my customers transition to a new solution?

This might mean recommending alternative services, creating guides to help them migrate their data or accounts, or even negotiating deals with similar businesses to ensure they aren’t left hanging.

That’s it for today, folks! We will be back again tomorrow with more valuable insights about ‘Bharat in Business.’ Till then, stay informed!