We won!

after a 🤏 loss

Hello guys, Good morning! How are we doing today? Did you recover from yesterday’s bearish ride? The early morning market gave us a lil bit of relief, and we are proud that y’all didn’t panic sell (yup, we read all your emails) 👀

So, let’s start our day with a good thought:

“Start where you are. Use what you have. Do what you can.”

That made us feel pumped! So, let’s take a nose dive into today’s happenings.

🎯 Top Headlines for the Day

Sensex and Nifty gain 0.8%

BLS International Services shares surge 10% following strong Q1 results

Unicommerce eSolutions IPO subscribed 1.28 times on opening day

📊 Market Pulse

Now, if you are in the mood for investing today, then you shouldn’t miss these:

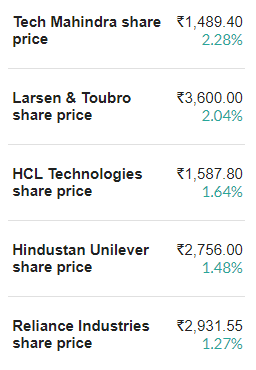

Top Performers so far 👇

Stocks to Avoid 👇

🍾 Some Good News

Bharat’s textile makers are strutting their stuff on the stock market runway as Bangladesh’s political drama turns into a supply chain soap opera. With Prime Minister Sheikh Hasina fleeing the scene amid a flurry of protests and chaos, Indian textile companies are reveling in their new role as potential global heroes.

Shares of Bharat’s textile giants like KPR Mill, Arvind Ltd., Gokaldas Exports Ltd., Vardhman Textiles Ltd., and Welspun Living Ltd. have skyrocketed by over 10% in Mumbai, like a rocket taking off during a fireworks show. Investors are banking on these companies snatching up the global market share now that Bangladesh, the second-largest textile exporter after China, might be on the ropes.

For a bit of perspective, Bangladesh’s textile exports were worth a whopping $45 billion in 2022, which is more than double Bharat’s textile export figures. But with the country’s political scene resembling a high-stakes drama series, global buyers are starting to look at alternatives.

🙄 Crypto’s Shenanigans

Binance is facing a hefty $86 million tax slap from Bharat’s Directorate General of Goods and Services Tax Intelligence (DGGI). Yes, you read that right—$86 million!

The DGGI, which is basically the tax watchdog with a magnifying glass, has issued this showcause notice, accusing Binance of sneaking fees from Bharat’s traders between July 2017 and March 2024. This is big news because it’s potentially the first time an international crypto giant has been caught in the DGGI’s crosshairs.

Binance is currently channeling its inner Sherlock Holmes to review the notice and is playing nice with Indian tax authorities. Meanwhile, the DGGI has decided to keep mum about the case for now—maybe they're busy drafting their next blockbuster tax drama? 👀

BTW,

In June, Binance was already handed a $2.2 million fine for not keeping up with India’s anti-money laundering rules. It’s like being given a detention slip for not doing your homework, and now there’s an even bigger test ahead. But don't worry, Binance has been working hard to get all its paperwork in order and is now a registered entity with the Financial Intelligence Unit (FIU), so this tax debacle is on a separate track.

⚠️ Hold UP

Bharat.Inc believes that growth comes from support. So, here’s an open call to all the business owners to get themselves featured RIGHT HERE!

Sounds interesting? Then you ought to see what we have in stock for you ✨

Fill up the form below, and we will get in touch with you in no time!

So, that’s it for today, folks! See ya tomorrow 👋 Till then, stay informed and keep winning!

Quite informative!!