Why Should You Never Get An Investor?

Hello everyone! We were worried that yesterday’s newsletter demotivated y’all, but we saw your messages and loved the go-getter attitude you guys showed. That’s exactly what we wanted to bring out! So, today, we’re back to break another myth about doing business.

So, let’s start with a positive thought:

“The best way to predict the future is to create it”

Knowing that your actions today can shape your tomorrow can motivate you to take initiative, work on your goals, and make positive changes. Rather than leaving things to chance, you take ownership of your future, making deliberate choices that lead to the outcomes you desire.

Now, let’s get started…

🎯 Top Headlines of the Day

Bank of Baroda secures Rs 5,000 crore with infrastructure bonds

Zee and Sony resolve $10 billion merger dispute

Infosys stock surges to 52-week peak, up 32% in 3 months

📊 Market Pulse

Today’s top-performing stocks are:

Today’s low-performing stocks are:

⚠️ Hold UP

Bharat.Inc believes that growth comes from support. So, here’s an open call to all the business owners to get themselves featured RIGHT HERE!

Sounds interesting? Then you ought to see what we have in stock for you ✨

Fill up the form below, and we will get in touch with you in no time!

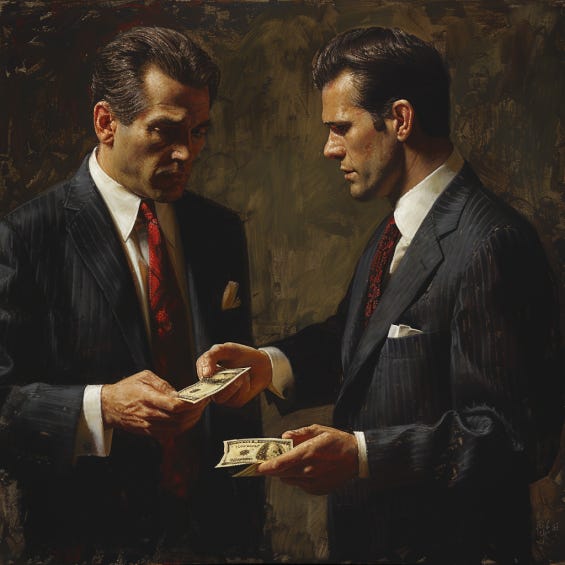

How a Co-founder Can Ruin Your Business?

Have you ever caught daydreaming about your startup skyrocketing to success with a few million in investor cash? That surge of funds to take your business to the next level is pretty tempting, isn’t it?

But hold on a sec—before you start polishing up that pitch deck, let’s take a step back and look at a side of investment that doesn’t get talked about enough: the real cost of handing over control:

📌 Cultural Clash

Let’s talk about culture—the heartbeat of your startup. You’ve built something special, a place where innovation thrives, creativity flows, and everyone’s in it together because they believe in the vision.

But here’s the thing: bringing in investors can shake that up, especially if they come from a more traditional business background. You know, the kind where there’s a clear chain of command, suits, and ties, and a big focus on metrics and profit margins. Suddenly, the relaxed, flexible environment that makes your team tick might feel like it’s under scrutiny.

This is where the cultural clash comes in. Investors might want to change things that they don’t fully understand, thinking it’ll make the business safer or more efficient. But in doing so, they could stifle the innovation and passion that got you where you are.

And it’s not just an internal issue. Your customers—those who love you for being different—might start noticing changes too. If your brand starts to feel more corporate and less like the quirky, disruptive force it used to be, they might feel disconnected. So, the last thing you want is to lose the loyalty and trust you’ve worked so hard to build.

📌 Invisible Debt

Let’s be honest—getting a big check from an investor feels like hitting the jackpot. You’re not dealing with loan repayments or interest rates, so it’s easy to think, “Hey, this is free money!” But here’s the thing: equity isn’t free. When you give up equity, you’re actually taking on a different kind of debt, one that doesn’t show up on your financial statements but can seriously affect how you run your business.

One of the first things that happens when your ownership stake decreases is that your decision-making power starts to fade. Early on, when you own the majority of the company, you call the shots. But as more investors come in, their voices start to get louder. Suddenly, decisions that you used to make on your own—like where to take the business next or who to hire—become group discussions.

So, before you go all-in on getting investors, ask yourself: Is the money worth giving up control? Because that invisible debt might just cost you more than you think.

📌 The Pivot Trap

Investors are primarily interested in maximizing returns on their investment, and if they believe that a different market or product line could be more profitable, they may push hard for a pivot. This pressure can be relentless, especially if initial results aren’t meeting their expectations. They might argue that shifting focus is essential for survival or growth, and on paper, their reasoning might seem sound.

But here’s the catch: these investor-driven pivots are often based on financial projections and market trends rather than a deep understanding of your original vision or the nuances of your core business.

Moreover, a pivot driven by investors can create tension within your team. Your employees, who joined your startup to be part of a specific mission, might feel disillusioned or resistant to the new direction. This can lead to a drop in morale and even key talent leaving the company.

Lastly, the Pivot Trap isn’t just about changing direction; it’s about losing sight of your original destination. If a pivot is necessary, it should come from a place of strategic insight and alignment with your core values—not as a reaction to investor pressure.

That’s it for today, folks! We will be back again tomorrow with more valuable insights about ‘Bharat in Business.’ Till then, stay informed, and keep hustling!