Your Business Is In Danger!

this August 16

Hi guys! We see you loved our story yesterday. So, we’re back today with another interesting story. But, before we get started, let’s start our day with a positive thought:

Kindness creates ripples

Acts of kindness trigger the release of endorphins, the brain's natural "feel-good" chemicals. This creates a positive feedback loop, lifting your spirits and energizing you for the day ahead. When you're kind to others, it strengthens your bonds with them, fostering trust and goodwill.

On that good note, let’s get started…

🎯 Top Headlines of the Day

Sachin Tendulkar’s investment in Brainbees Solutions swells to over Rs 14 crore

Ola Electric shares surge 50% above IPO price

Ratan Tata's early bet on FirstCry’s parent company Brainbees pays off with 670% return

📊 Market Pulse

If you’re in the mood for investing today, here are some stocks that you should consider:

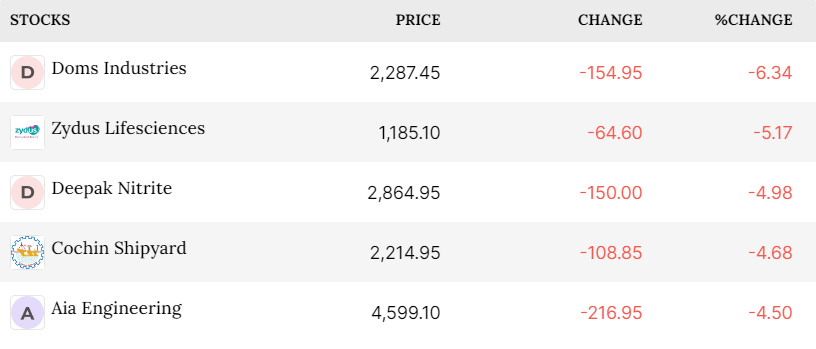

However, you should also keep a tab on the stocks that are falling today:

How This 16th August Can Save Your Business?

The taxman is back at it, and this time, it's a full-blown nationwide hunt for phony GST registrations! From 16 August to 15 October, the Central and state authorities are rolling up their sleeves and diving headfirst into a two-month-long mission to sniff out the fakes, frauds, and funny business hiding in the GST system.

According to the Central Board of Indirect Taxes and Customs (CBIC), this operation is not just a routine check-up—it's a full-scale operation to expose those crafty entities that think they can outsmart the taxman with their bogus invoices. Got a GST number but no real business to back it up? Prepare for your registration to be suspended faster than you can say “tax evasion.”

But wait, there's more!

The tax sleuths are not stopping at just canceling fake registrations. They’re also on a mission to block those sneaky input tax credits that have been wrongly claimed on the back of fake invoices. Businesses that have been cozying up to these fictitious entities may soon find themselves on the receiving end of a hefty tax recovery bill. Talk about a plot twist!

However, as with any big operation, there’s a small chance that some genuine businesses might accidentally get caught in the crossfire. The authorities are urging businesses to double-check the credibility of their partners—because no one wants to be unfairly flagged for doing business with a phantom company.

So, if you’re a business owner, it’s time to make sure your books are clean, your partners are legit, and your invoices are as real as they come.

So, what should you do if your business is clean?

If you're an honest business, here’s your playbook to stay on the good side of this nationwide GST crackdown:

Audit Your Partnerships: Start by giving your business partners a good once-over. Make sure everyone you're dealing with is above board and not just a tax-dodging ghost. If they’re shady, it’s time to cut ties—better safe than sorry!

Keep Your Paperwork Pristine: Ensure that all your invoices, GST filings, and financial records are in tip-top shape. Double-check that your input tax credits are based on genuine transactions with real goods or services. No funny business here!

Be Vigilant with New Deals: Before you seal the deal with any new partner, do a little detective work. Verify their GST registration and check their track record. If something feels off, it probably is. Trust your instincts and move on.

Stay Updated on GST Rules: The tax landscape is always shifting, so make sure you're up to date on the latest GST regulations and compliance requirements. Being informed is your best defense against unintentional slip-ups.

Cooperate with the Authorities: If the tax authorities come knocking, don’t panic. Be ready to provide all necessary documentation and cooperate fully. Transparency is your best friend in these situations.

Seek Professional Help: If you’re feeling unsure, don’t hesitate to get some expert advice. A good tax consultant can help you navigate these waters, ensuring your business stays compliant and stress-free.

Educate Your Team: Make sure everyone in your business understands the importance of compliance. From your accounting department to your sales team, everyone should be on the same page about keeping things legit.

⚠️ Hold UP

Bharat.Inc believes that growth comes from support. So, here’s an open call to all the business owners to get themselves featured RIGHT HERE!

Sounds interesting? Then you ought to see what we have in stock for you ✨

Fill up the form below, and we will get in touch with you in no time!

That’s it for today, folks! We will be back again tomorrow with more valuable insights about ‘Bharat in Business.’ Till then, stay informed and file your taxes on time!