The new income tax bill can access your Instagram

unpacking the bill

You've made it to the end of the week, time to grab a cup of chai (or something stronger, no judgment) and unwind.

But before you do, there's something brewing in Parliament that might just slide into your DMs before your crush does.

Now, let’s get started…

The recently introduced Income Tax Bill 2025 has become a focal point of national discussion, stirring debates about privacy, governance, and the balance between state authority and individual freedoms. So, what’s inside the bill about?

Introduced by Finance Minister Nirmala Sitharaman on February 13, 2025, the Income Tax Bill 2025 aims to modernize India's tax framework.

A notable provision grants tax authorities the power to access individuals' digital domains: emails, social media accounts, bank details, and trading transactions, without a warrant or prior notice, based solely on suspicion of tax evasion or undisclosed assets.

Specifically, Clause 247 of the bill empowers tax officers to override security measures on digital platforms, allowing them to access various digital platforms, including email servers, online investment accounts, and social media, which were not explicitly covered under the existing law.

Key provisions of the bill:

1. Access computer systems, emails, social media accounts, and other digital platforms if there is suspicion of tax evasion or undisclosed assets.

2. Override security measures, such as passwords or access codes, to inspect financial and communication data.

3. Enter and search any building, place, or digital space where access is not readily available, including breaking locks or overriding digital security protocols.How are the political figures reacting to this?

The Congress party has been particularly vocal in its opposition, framing the bill as a governmental overreach into personal lives and a potential tool to stifle dissent. Supriya Shrinate, head of the Congress social media department, expressed concerns that the bill permits tax officials to monitor private communications and financial transactions without concrete evidence, merely on suspicion.

Proponents of the bill argue that these measures are necessary to combat sophisticated tax evasion tactics in the digital age.

They believe that empowering tax authorities to access digital platforms will enhance transparency and accountability in tax processes.And what’s the public’s take?

The introduction of the bill has sparked varied reactions among citizens.

While some acknowledge the need for stringent measures to curb tax evasion, others fear potential misuse of power.

The debate continues as stakeholders from various sectors call for a balanced approach that safeguards individual privacy while addressing the state's legitimate interests in tax collection.

What’s the current status of the bill?

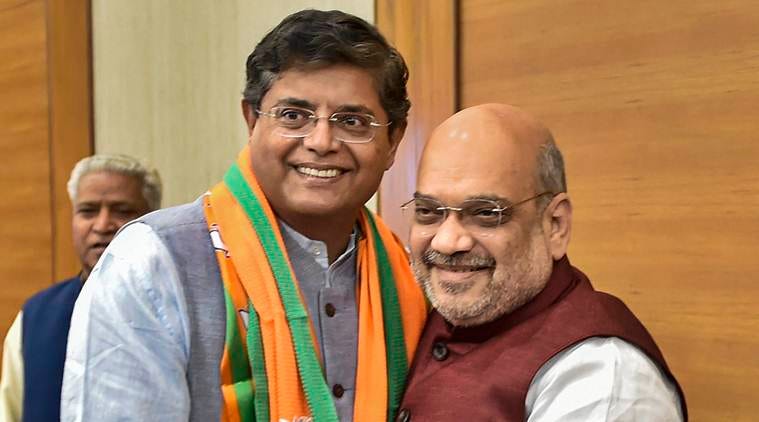

A 31-member Select Committee, led by BJP’s Baijayant Panda, is currently reviewing the bill’s implications for privacy and legal compliance.

While the government argues the bill enhances tax enforcement, concerns persist over its potential misuse for political and personal targeting.

The final shape of the legislation depends on ongoing discussions in Parliament and public scrutiny.

So, that’s it for today. If you enjoyed this edition, subscribe to hear from us every day!

See ya 👋